If only the GOP was more like Willie Sutton

If they insist on stealing from health care to pay for renewing tax breaks for corporations and the wealthy, they should go where the money is -- in Medicare Advantage

To extend the 2017 Trump tax cuts, which will increase the federal deficit at least $2 trillion and possibly more over the next decade, the GOP leadership in Congress is targeting Medicaid, the health insurance plan that covers more than 70 million low-income Americans and pays the lowest prices to hospitals, doctors and other providers.

House Speaker Mike Johnson (R-LA) on Monday rejected pleas from GOP congressmen in swing districts to take Medicaid cuts off the table. Even some MAGA conservatives are upset, an understandable response given that many GOP-run states have a large share of their populations on Medicaid and depend more than liberal states on federal financing.

“No,” Johnson replied yesterday when asked if he would offer any concessions to those members, according to an article in Politico. The budget resolution that will be voted on today includes $880 billion in cuts to “health care” programs over the next decade, the vast majority of which would come from Medicaid. President Trump promised not to touch Medicare (he recently added Medicaid to that promise, too). “There’s nothing specific about Medicaid in the resolution,” Johnson dutifully repeated.

See As G.O.P. Eyes Medicaid Cuts, States Could be Left With Shortfalls in New York Times.

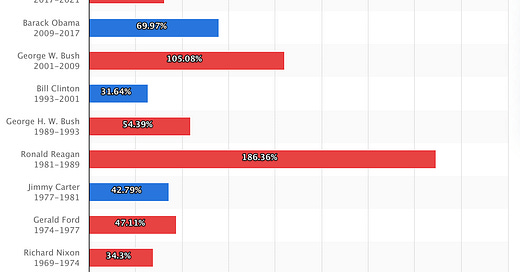

Their subterfuge aside, the reality is that the GOP could care less about budget deficits. Over the past half century, they’ve exhibited a “what me worry” attitude when it comes to cutting taxes for corporations and the wealthy, especially when one of their own is in the White House.

When does debt soar the most?

As I pointed out last week, if the GOP insists on cutting health care to offset some of the cost of extending the 2017 tax giveaway, it should reduce overpayments to Medicare Advantage plans. Privatized Medicare, which charged the government $462 billion in 2024 to cover 54% of all seniors, cost $83 billion more than if those beneficiaries had remained in the government-run program, according to the Medicare Payment Advisory Commission.

The Congressional Budget Office, in its regular update of Congressional options for cutting spending and raising revenue, projected that reducing overpayments to MA plans could save the program over $1 trillion over the next decade. That’s enough money to accomplish any (or all) of the following: extend the life of the Medicare trust fund; expand coverage to include hearing and dental care for all beneficiaries; or further reduce out-of-pocket spending (beyond the $2,000 cap on drug spending enacted under President Biden).

The chief reason why the capitated payments to MA plans (insurers receive a flat annual fee for each enrollee) are higher than traditional Medicare is that they are adjusted to account for the relative health of people in the plan. If MA beneficiaries are sicker than average, the plan receives a higher payment.

That has led most insurers to engage in “upcoding,” where they review medical records or encourage physicians and nurses to identify conditions that aren’t being treated (and in many cases don’t need to be treated). Medicare pays the plans based on the risk profile, not the actual care being delivered.

Are MA beneficiaries actually sicker?

Of course, the possibility exists that the people signing up for Medicare Advantage have more underlying conditions and wind up being more costly to treat than seniors remaining in traditional Medicare. A new study published this week in the Annals of Internal Medicine knocks a huge hole in that thesis.

A 6-member team of researchers led by Andrew Oseran at Beth Israel Deaconess Medical Center in Boston, which studied a representative sample from both programs, found no difference between Medicare and Medicare Advantage enrollees in four out of five important measures the health status. They were obesity, high blood pressure, high cholesterol and chronic kidney disease.

The beauty of their study was that the authors used the National Health and Nutrition Examination Survey conducted by the Centers for Disease Control and Prevention, which derives its data from in-person interviews and independent clinical tests. They then matched that data with Medicare enrollment status. An accompanying editorial by Amal N. Trivedi of Brown University and Richard Kronick of the University of California San Diego pointed out their method “provides a true population based prevalence estimates of chronic conditions by capturing all persons with that condition, regardless of a health care diagnosis.”

The study did find that Medicare Advantage enrollees had a slightly higher incidence of diabetes. The study authors suggested this might be due in part to MA plans having a higher proportion of Blacks and Hispanics, who have higher rates of diabetes. One reason a larger share of minorities join MA plans is that they have lower upfront costs and tout their extra benefits in advertising targeted at minority communities.

Still, that one difference of seven percentage points in a condition that affects less than a third of beneficiaries can’t account for the 18% higher payments made to MA plans in 2024. “This study highlights the value of including objective information that is less susceptible to coding practices,” Trivedi and Kronick wrote. “Because the MA population is unlikely to be sicker than the traditional Medicare population, the Centers for Medicare and Medicaid Services could consider excluding diagnoses from the payment system,” especially when there are large and unexplained differences between the two populations.

The other option is to simply make the payments to MA plans equal to the amount paid in traditional Medicare. The CMS currently lowers MA payments by 5.9% across-the-board to counteract upcoding. The CBO estimated raising that to 20% — only slightly higher than the 18% overpayment level recorded last year — would lower total Medicare costs by over $1 trillion over the next decade. (The amount would be somewhat less if CMS aimed the cuts only at plans that engage in upcoding.)

Medicare Advantage was supposed to save the government money. Isn’t it time for taxpayers to earn a return on the two decades of overpayments to the private insurance companies that manage a growing share of Medicare?

As Trivedi and Kronick wrote at the end of their editorial, “Policymakers seeking to reduce health spending would better serve taxpayers by curbing MA overpayments rather than targeting Medicaid for savings.”

Let me start off by saying that there is no fig leaf large enough to hide the embarrassment of excessive payments to Medicare Advantage plans. Between risk adjustment and the Stars bonus payments, it has gotten to be too much.

Let me also color in some important insights to temper the outrage a little. By comparing Medicare Advantage with Original Medicare payments, we miss the important fact that they are oranges and apples. In Original Medicare, physicians are paid on a fee for service basis where the all important input is the Current Procedural Terminology (CPT) codes, a universal language for identifying medical services and procedures. They are used by healthcare providers to report services to insurance companies. Physician practices aim to report these to the highest degree of accuracy. They must be accompanied by at least one diagnostic code that agrees with the procedure, no more than this minimum.

Under Medicare Advantage programs, the health plan must report the most accurate and comprehensive list of diagnoses (ICD-10 codes) along with a qualifying CPT code. This is the inverse of Fee for Service Medicare. The reason for this is that the flat monthly payment rates to the Medicare Advantage plans is adjusted based on the severity and complexity of health conditions and co-morbidities.

These two parallel worlds (Fee for service Medicare versus Medicare Advantage) produce very different burdens of illness: fee for service severely under-reports because it does not affect payment levels, while the opposite is true for Medicare Advantage. Therefore, if two Medicare patients with exactly the same objective diagnostic burdens of illness are compared, you will see under-reported diseases in fee for service, even though they may be under treatment for the same things. Unless we compensate physicians in the exact same manner, we will always see different burdens of disease reported.

The trouble with Medicare Advantage begins when potential diagnoses begin to be reported that are not actually being treated or monitored by the physician, the diagnostic code creep happens that artificially inflates risk scores and Medicare Advantage payments. This is why risk adjustment validation audits (RADV) are conducted: to identify and penalize Medicare Advantage plans that abuse or are careless in their reporting of ICD-10 codes. It is likely that some MA plans intentionally game the system.

The HHS OIG has been ramping up efforts to prosecute these offenders. However, now that the new administration has sacked all the OIGs, it will be a serious setback to this policing effort. I worry that without anyone watching over the RADV efforts, bad things may continue.

Merrill, sure, the economics of cutting back Medicare Advantage over payments is very clear. However the politics are difficult. Cutting the MA payments could backfire on politicians who vote for it, including Democrats. I have been watching MA since it's inception and was worried from the beginning that it would be attractive to Medicare participants. And as we have seen these plans are, in fact, very popular and now cover a majority of Medicare members. Not all of the over payments to to insurance company profits. A substantial amount of the cash benefits the participants in terms of lower premiums (even zero!), the inclusion of prescription drugs, and sweeteners like dental and vision. If MA plans were paid less, what would they do? Take less in profits??? The question answers itself. The MA participants would be threatened with higher premiums and reduced benefits and turned loose on their Congresspeople! Politically who would try this? The Democrats! Who would be blamed?

A better long-term approach would be to raise taxes on the rich to improve traditional Medicare to the point that it was attractive. Eliminate cost sharing so there is no need for Supplemental Plans. Expand benefits to include dental, vision, hearing. And lower the Medicare eligibility age to 60. And regulate the profit of the MA insurers. They can be private, but they have to be regulated!

This puts the Democrats on the side of all retirees and against profiteering insurance companies.