The real freeloaders in our employer-based health insurance system

Employers fail to provide coverage for tens of millions of full-time workers, many of whom only qualify for Medicaid because of their near-poverty wages.

The main GOP talking point for the Medicaid work requirements inserted in the corporate welfare bill scheduled for a vote in the House of Representatives Thursday is that they are necessary to eliminate “waste, fraud and abuse” in the program.

"We have to eliminate people on Medicaid who are not actually eligible to be there,” House Speaker Mike Johnson (R-LA) said earlier this year. “Able-bodied workers for example, young men who should never be on the program at all."

The implication — crafted to please the Fox News-driven howling mob — is that able-bodied males are just a bunch of loafers taking advantage of a program that they wouldn’t need if they just went out and found a job.

Hmmm. According to the latest Kaiser Family Foundation analysis of the Medicaid population (nearly 60% of whom are children, disabled adults and the destitute elderly), there were only 2 million able-bodied adults (men and women) in the program who weren’t working. Another 5 million were working part-time.

If you eliminated every last one of those two groups from Medicaid, it wouldn’t add up to the estimated 10.3 million people the Congressional Budget Office estimates will lose Medicaid coverage under the latest version of the Trump-backed bill. (Remember his promise not to touch Medicaid?) The 80-hours-a-month work requirement accounts for about a third of those cut from the roll.

The rest will come from other provisions in the proposed law. It sets up new paperwork barriers to enrolling and reenrolling in the program; it requires twice-a-year reassessments of eligibility; and it reduces financial support to the 49 states that charge the federal government for taxes they levy on health care providers, which will leave them without funds to maintain current enrollment levels.

The bill’s true objective is to eliminate as many working-age people as possible from the program to help pay for corporate and wealthy individuals’ tax cuts. Those axed will include many people working full-time who became eligible for Medicaid under the program’s Affordable Care Act expansion. There were 11.5 million such souls in 2023.

Instead of picking on poor workers, Congress should be addressing this question: Why are so many working people now on Medicaid, a program originally designed for the poor? That simple question deserves a simple answer. It’s because their employers don’t offer health insurance, and even among those that do, many of their workers fail to sign up because they are so poor they can’t afford the co-premiums, co-pays and deductibles.

In the 40 states and District of Columbia that expanded Medicaid under the ACA, you must earn under 138% of the federal poverty level before you can join a state’s plan. In 2025, that is $15,650 for a single person and $26,650 for a family of three.

Who makes that little despite working at least 35 hours a week? They include many non-union construction workers, farmworkers, restaurant servers and dishwashers, hotel housekeepers, home health and nurse aides, fast food employees, daycare workers, and gig workers in the home delivery, taxi, and other tech-enabled service industries. Or they may be dogwalkers, au pairs and cleaning ladies for the upper middle class, who can afford such luxuries as long as they don’t pay for their off-the-books employees’ health, unemployment and workers compensation insurance.

The 2 1/2-legged stool

The U.S. health insurance system is sometimes referred to as a three-legged stool. For adults between the ages of 19 and 64 and their dependents, employers provide coverage. Medicare covers the old. And Medicaid covers the poor, who for reasons like disability, caring for dependents, being in school or temporary unemployment, don’t work and therefore aren’t eligible for employer-based coverage.

Pull one out or cut it down in size, the stool falls over.

Yet, according to a 2022 survey by the Census Bureau, about 18 million people or 14% of all private-sector employees worked for companies that fail to offer health insurance. Their employees’ only other options are to buy subsidized plans on the ACA exchanges (the amount of the subsidy depends on income) or apply for Medicaid if they earn less than 138% of the poverty level (as long as they live in one of those 40 states and D.C. that expanded the program under the ACA). If they live in the other ten states, they fall into what is quaintly called the coverage gap.

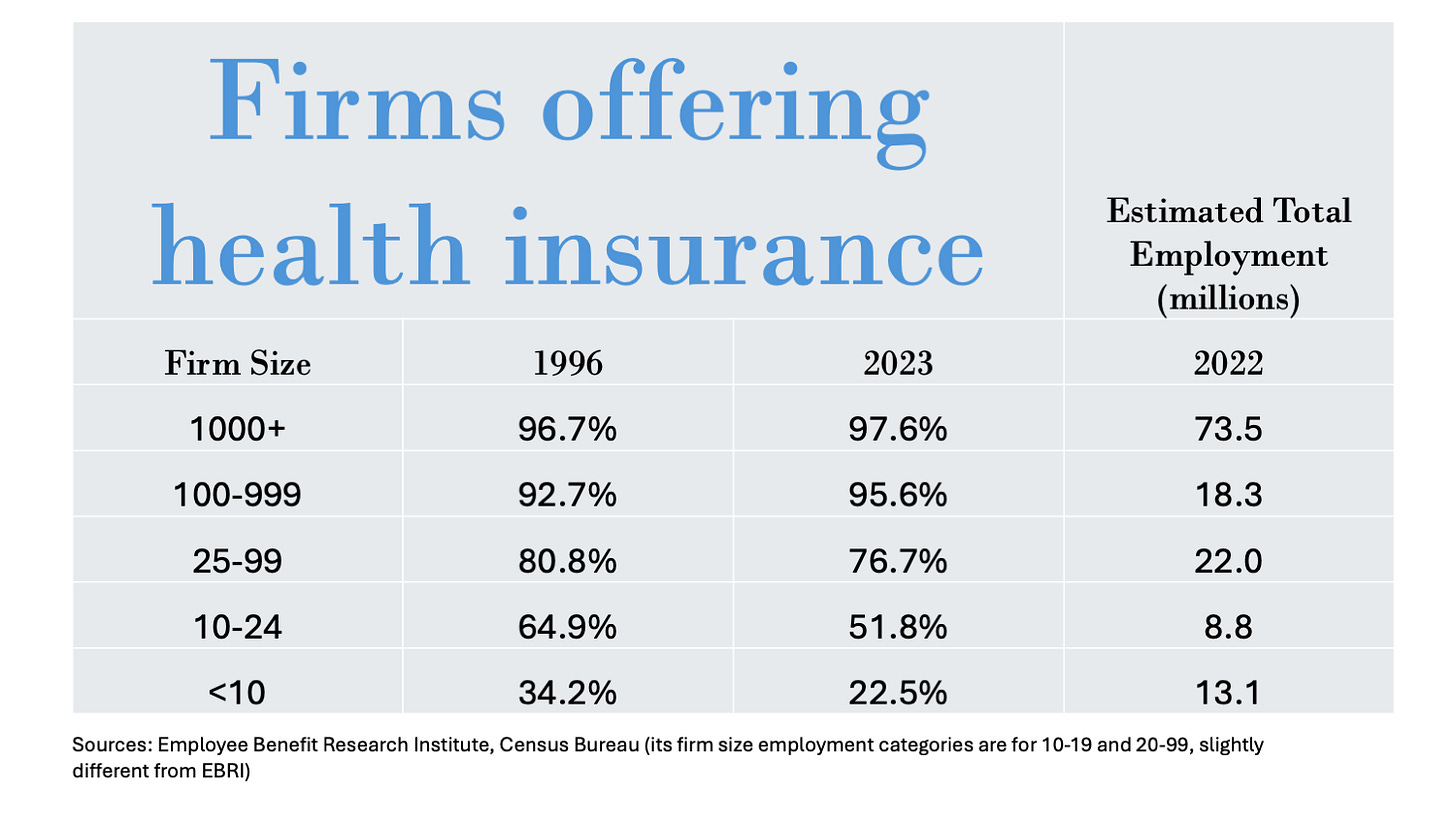

This failure to provide coverage is largely a small business issue, one that has grown worse over the past three decades with the rise of gig work, the decline of unions and the increasing dominance of viciously antilabor finance capital and private equity in most sectors of the economy. Nearly one of every four firms with fewer than 100 employees, which in total employed over 44 million people in 2022, failed to offer health insurance. For the 13 million people working at firms with less than 10 employees, three out of every four firms failed to provide coverage.

But even at firms that offer coverage, 19% of employees can’t sign up because they are part-time, temporary or a relatively new employee who is still in the waiting period before becoming eligible for coverage. Among those eligible, just three-fourths sign up, usually because they can’t afford another deduction from their paltry paychecks.

The average premium for all workers in employer-sponsored coverage is $1,368 a year for a single person and $6,296 a year for a family plan, according to the most recent Kaiser Family Foundation health benefits survey. Many are scared off by the high deductibles, which now average close to $1,800 out-of-pocket before their insurance even kicks in.

In short, the high cost of health care is driving small employers, individuals and working families from the private insurance system. The only reason why the uninsured rate fell to around 8% in recent years (from around 17% when President Obama took office) is that the government subsidized coverage through the ACA exchanges and Medicaid.

Employer hypocrisy

Let’s be clear. Employers of every size have barely lifted a finger to prevent the slow-motion collapse of the system their political arms worked assiduously to maintain. The U.S. Chamber of Commerce and the National Association of Manufacturers use their lobbying clout to preserve the tax deduction for their share of health care premiums, arguing the employer-based system is crucial to their being able to attract and retain high quality employees.

Yet industry surveys suggest just one quarter of Fortune 500 companies have adopted tiered insurance premiums, where lower-paid workers pay less monthly for their coverage compared to higher paid employees. This despite the ACA penalizing companies $3,000 a year if an employee offered health insurance on the job opts for a subsidized ACA plan because their company’s co-premium went over 9.02% of their adjusted gross income.

On the flip side, should that relatively low-paid employee decline to buy into their employer-provided plan because their premium is below that threshold, say, 8% of AGI ($2,000 for someone earning $25,000 a year), they are not be allowed to buy the heavily subsidized and therefore more affordable plan on the ACA exchange.

Our employer-based health insurance system is clearly failing workers in the lower half of the income distribution. Fully 25% of all workers in this country are earning less than $43,000 a year or not even twice the cost of the average family health insurance plan. The average out-of-pocket premium for that plan this year is over $500 or nearly 14% of total income before taxes.

The answer under the ACA aka Obamacare was subsidization for people buying individual or family plans on the exchanges. It expanded Medicaid for people earning near-poverty wages. The hodgepodge of rules and regulations implementing Obamacare managed to cut the uninsured rate in half.

Now, the U.S. government under complete GOP control is on the verge of sending the uninsured rate back into double digits. I’ve written this many times before but it is worth repeating. The uninsured do not abstain from receiving care. A lack of money and health insurance means they abstain from receiving preventive care. They abstain from receiving timely care. They show up at doctors’ offices and emergency rooms when their illnesses have progressed, when it is more expensive to treat, and when, all too often, it is too late to prevent permanent harm and premature death.

The cost of this more expensive and too often fruitless care is paid by every privately insured person in the U.S. and the businesses that employ them, whose premiums soar to pay for providers’ uncompensated care. The cost to society is a set of outcomes that trail every other rich country on every major indice of public health. We suffer worse longevity; worse infant and maternal mortality; worse chronic disease incidence; and worse preventable disease mortality. Universal health insurance doesn’t solve those problems, but it is a necessary precondition for tackling them.

Our fragmented, failing health insurance is a violation of human rights and a permanent stain on the United States. Please take time this week to contact your representative — especially if you live in a Congressional district represented by a Republican. Ask them to vote no on this outrageous bill. Remind them that we are the richest country on earth yet remain the only one in the advanced industrial world without universal health insurance, a pathetic record their president and their leaders are asking them to make worse.

Yes a very thoughtful and thorough discussion. When working years ago in a medical practice I came across multiple new hires of a local Walmart. When I asked if the company provided health insurance they answered the day they were hired they were given a form to apply for Medicaid coverage for their health insurance. I am sure things have changed since then, but I was disgusted by one of the richest families in U.S. barely paying livable wages and dumping insurance coverage onto the state.

So where are we headed?? The big beautiful bill is probably a done deal. We are headed for hard times. Sending letters to Congress members is barely enough and mostly ineffective where needed. The wholesale bribery of our lawmakers and certain courts is set against the people. The proposed increased funding of the military appears to be a ploy to enforce possible martial law. Tax breaks to the rich and powerful will keep them at bay. It comes down to people and communities supporting each other. And the need for a mass uprising to overthrow this catastrophic system of pure evil and corruption. Then hopefully a more sane and empathetic government that treats all humans and our environment fairly and with respect. It will be a battle.

All true and don’t forget minimum wage. We don’t offer a livable wage to most people along with no child care. I don’t mind paying taxes as long as it goes to our people, not subsidies for billionaires and wealthy corporations.