Will hospital building boom doom cost control?

A $2 billion expansion of Mass General Brigham in Boston could open the floodgates

This story first appeared in the Washington Monthly.

Stories about therapeutic triumphs performed by the nation’s academic medical centers are a media staple: CAR-T therapy mobilizes the body’s immune system to fight cancer! Patients are rising from their deathbeds after double lung-heart transplants! Academic researchers played the crucial role in developing the COVID-19 mRNA vaccine!

And, if you’re like me, you have friends who, after receiving a dire diagnosis from their regular physician, hightailed it to a leading academic medical center (AMC) for a second opinion. They probably received their treatment there when the original diagnosis proved positive.

It’s called prestige medicine. Who wouldn’t want to go to Mayo, the Cleveland Clinic, or their local equivalent if you have a serious heart condition; or Memorial Sloan Kettering, MD Anderson, or the local academic cancer center if you develop a life-threatening tumor?

But is care there better? Not necessarily. As patient safety advocates like the Leapfrog Group have repeatedly shown, safety grades for leading academic hospitals can range anywhere from A to D, with some of the best known (like Northwestern and the University of Illinois in my home city of Chicago, for instance) barely earning passing marks.

As for outcomes, one recent study suggested that AMCs achieve better results than community hospitals when measured by death within the first 30 days after treatment. Yet the same study showed that they didn’t outperform when it came to routine surgical procedures. A recent health care consulting firm study was less sanguine, finding that AMCs actually trail their community-based rivals on key outcome measures.

One thing is for certain: AMCs cost more—a lot more if you are commercially insured. That has led many employers to adopt high-deductible plans, forcing patients to pick up the first $1,000 or more of the bill. Many insurers have begun excluding pricey academic centers from their networks, and many patients seeking out prestige medicine wind up paying higher out-of-pocket costs than if they went to their local community hospital.

But cost concerns have not stopped the nation’s 140-plus AMCs and their proliferating outpatient facilities from gaining substantial market share in recent years. In some markets, like Pittsburgh and Boston, they’ve become so dominant that no insurer can afford to exclude the system from its network, which gives AMCs extraordinary power to demand higher prices. And they do.

Recent developments are working to make this imbalance even worse in ways that will aggravate health care inflation and accelerate the rapid decline of community-based health care in rural and low-income areas across America, making the inequities of the current system even worse than they already are.

The big get bigger

Consider what is happening in Boston right now. Mass General Brigham (MGB), a recent combination of two of the nation’s elite medical institutions, both affiliated with Harvard Medical School, last year announced a $2.3 billion expansion plan that would both modernize its two flagship hospitals and grow them by more than 100 beds. The original plan also called for building three outpatient surgical facilities in wealthy suburbs. The expansion plan has drawn widespread opposition from local community hospitals, insurers, patient advocacy groups, the state attorney general and the Massachusetts Health Policy Commission, whose mission includes controlling costs.

Last week, MGB withdrew the suburban portion of its expansion plan in the face of that opposition. But the state is leaning toward approving the main hospitals’ $2 billion reconstruction plan. A win for MGB, which could come within days, will not only accelerate the restructuring of that city’s hospital sector but could also open the floodgates to similar projects in other markets and deal a severe setback to efforts to rein in total U.S. health care spending, which already consumes 20 percent of GDP, the highest in the world by a long shot.

The restructuring of the nation’s hospital sector began well before COVID, the result of hospital utilization trends that show every sign of resuming after the pandemic has wound down. Numerous large hospital construction projects have been announced by major academic medical centers in recent months.

The University of Chicago Medical Center recently announced plans to build a new $633 million cancer hospital, part of a $1 billion project that will grow its total capacity by 24 percent, to 597 beds. Several multi-billion-dollar expansion projects are under way at the University of California medical centers in San Diego and Irvine. Penn Medicine in Philadelphia just opened its $1.6 billion expansion project. There are also major projects on the drawing board at several big nonprofit systems that are dominant in their markets and serve as teaching hospitals for local medical schools.

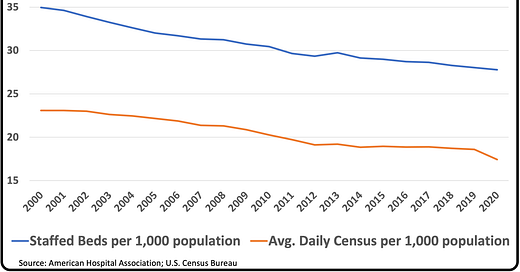

All this construction will be taking place amid stagnant hospital admissions. On a per capita basis, the number of patients entering hospitals has been on the decline for decades, according to data from the American Hospital Association. Advancing technology, the rise of outpatient surgical centers, and the growing hospital-at-home movement have combined to reduce hospital admissions and in-patient lengths of stay, and with that, a concomitant reduction in the number of staffed beds inside hospitals.

The losers have been community-based hospitals in cities and regions with stagnant or declining populations and rural hospitals. The winners have been large systems and AMCs, whose nonprofit status, stable balance sheets, and superior reputations enable them to capture patients previously served by neighboring, community hospitals. The Massachusetts commission study estimated that MGB’s $2 billion expansion would not only lead to sharply higher prices for commercially insured patients but also shift $261 million a year in existing spending to MGB from struggling community hospitals.

“These providers often operate on thin margins, so even a small shift could remove a key revenue stream that enables them to serve patients who are insured by MassHealth (the state’s Medicaid program) or Medicare or patients who are uninsured,” wrote Tim Murray, the president of the Worcester Chamber of Commerce, and Amy Rosenthal, executive director of Health Care For All, a consumer advocacy group, in CommonWealth magazine. “The financial instability could ultimately force them to close or scale back critical medical, behavioral health, and other services.”

Massachusetts is one of only five states that have adopted a system that sets annual benchmarks for overall spending on health care. In 2019, the year covered in the state’s most recent annual report, spending rose by 4.3 percent, well above the 3.1 percent benchmark.

The most expensive get bigger

The Health Policy Commission blamed Mass General Brigham, the most expensive system in the state, for much of the excess spending. This past January, the state ordered MGB to develop a performance improvement plan to lower its overall costs, the first time in its history the commission has issued such an order.

“Mass General Brigham has a spending problem,” says HPC chairman Stewart Altman, a professor of health policy at Brandeis University. “Continuing in this manner is likely to impact the state’s ability to meet its spending benchmark and could do serious harm to the structure of the state’s delivery system.”

MGB, for its part, has rejected every one of the policy commission’s assertions. It has run a huge local advertising campaign touting the expansion and sought to burnish its image with full-page ads in The New York Times, which has a wide readership in Boston. “It is important people know the facts, and advertising is just one way to make sure those facts are publicly known and set the record straight from unfounded claims,” Jennifer Street, a spokesperson for MGB, told The Boston Globe.

MGB rejected every objection to its planned expansion in a commissioned report submitted to the state agency, whose ruling on the request is imminent. “The predicted changes in Mass General Brigham’s shares associated with the proposed project are modest and unlikely to change the system’s bargaining leverage with health insurers meaningfully,” the report, prepared by the Charles River Associates consulting firm, said. “Rather, the weight of the economics literature suggests that allowing capacity-constrained health care providers such as Massachusetts General Hospital to expand puts downward pressure on health care prices and reduces expenditures on health care services.”

It is a curious assertion, given that the economics literature is equally suggestive of just the opposite. The MGB report gives short shrift to the life’s work of Stanford University’s Victor Fuchs, whose pioneering work since the 1960s has outlined the information asymmetry that drives patients to more expensive care and inhibits competition; the studies, books, and journalism by Atul Gawande from the Dartmouth Atlas of Health Care, which documents how provider-driven supply coupled with physician-induced demand leads to extensive variation in the quantity of health care delivered in different markets; and the voluminous literature on physician-driven demand.

In the absence of planning

The MGB report also failed to consider the rapidly changing health care marketplace. It projected a steady increase in demand based on the aging of the population. It didn’t mention advances in technology driving surgeries and procedures to outpatient settings or the changing patient preferences for shorter stays and at-home care.

Neither Mass General Brigham nor the Health Policy Commission considered what should go into reconstructing the biggest hospital in Boston. What about flexible facilities to accommodate future pandemics, natural or man-made disasters, or mass casualty events? How can new construction projects better serve residents in low-income neighborhoods, who are in worse health and often have poor access to decent health care facilities? The public debate in Boston—and nationwide—is nonexistent.

I posed that question to Altman of the HPC. “Who’s doing planning for the future? We’ve stopped focusing on that,” he replied. “A number of people are focusing on concentration. But most of the research I see focuses on very different subjects. Planning used to be a very important subject, but it was abandoned in the 1980s. That decision really needs to be reviewed.”

Indeed, symptomatic of end-stage parasitic capitalism which has completely captured medicine and converted it to the medical services industrial complex. These AMC expansions are monopolistic skimming scams designed to harvest the best reimbursed consumer cream from the reimbursement mess. Without regard to consequences on the rest of the system. Their purchased politicians see that there is no effective regulation or national health policy to assure affordable care for the whole population. Their reputations are now just marketing. Sad. Ricord B Winstead, MD (thankfully retired)