CMS finally proposes a small cut in privatized Medicare

The comments are in. Now the lobbying begins. Will the agency stick to its guns?

A few weeks ago, the Centers for Medicare and Medicaid Services proposed a small cut in the overly generous funding that Medicare Advantage plans receive for covering seniors and the disabled on Medicare. AHIP, the insurance industry’s trade group, greeted the proposed 0.2% pay cut, which would go into effect in 2025, with its usual predictions of disaster.

If enacted, the rule “could diminish the value and affordability of the MA benefits that millions of seniors and people with disabilities count on,” the group warned Friday, which was the last day for submitting comments to CMS about the 2025 reimbursement schedule. It “could lead to higher premiums and benefit reductions for enrollees.”

That’s exactly what the group predicted a year ago when CMS proposed a then record low 1% increase, which was well below inflation in the cost of medical services. CMS heard their pleas and eventually gave MA plans a 3.3% pay hike.

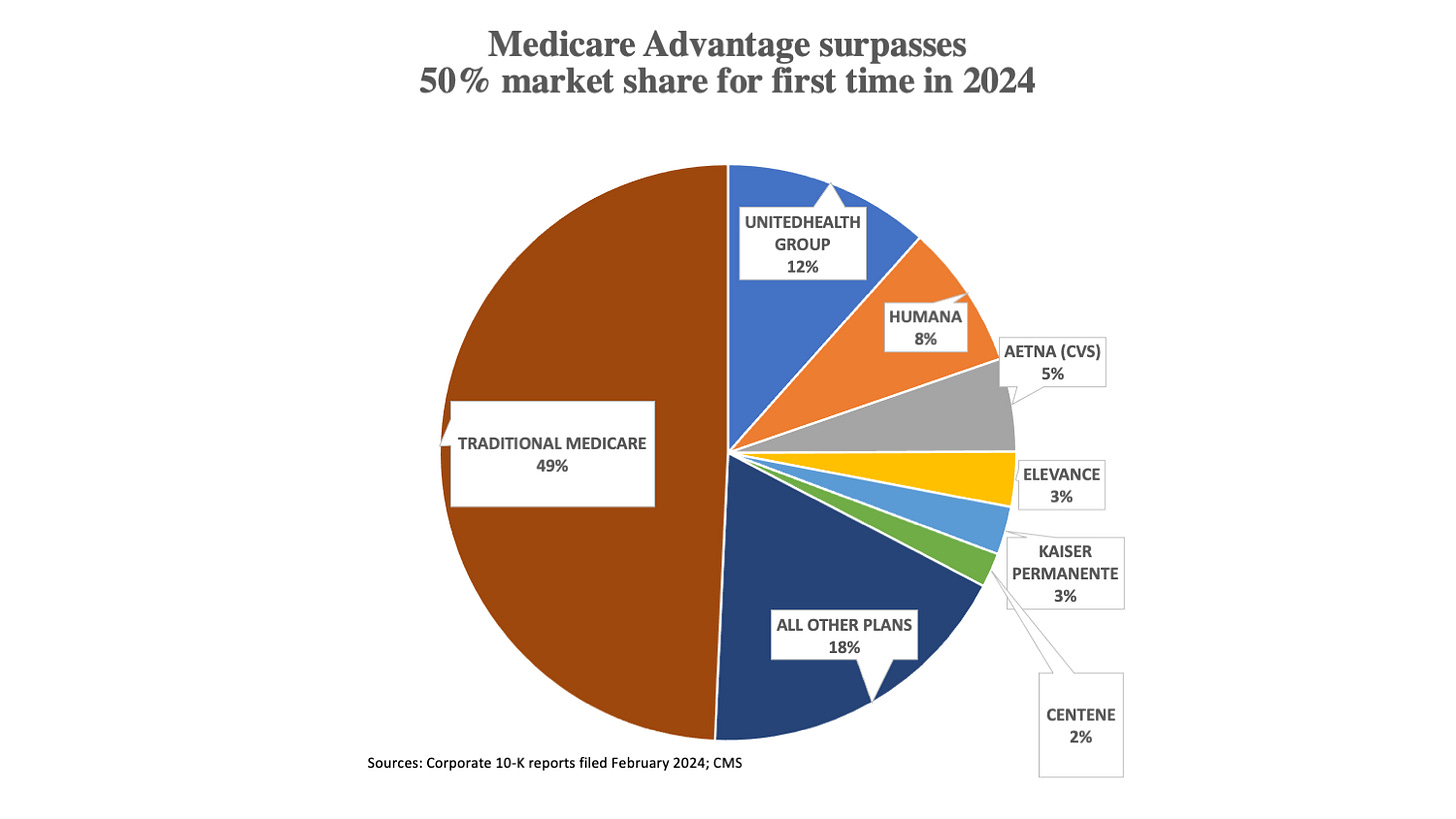

Is this history of caving in on the part of the agency about to repeat itself? Given that the privatization of Medicare receives bipartisan support on Capitol Hill and a growing number of people are joining MA plans (the recently concluded enrollment period concluded with more than half of all beneficiaries opting for private plans for the first time ever), I’d wager yes if I were a betting man.

Most Americans, including the 33.7 million seniors who just signed up for 2024 MA plans, have no idea that MA plan insurers receive more than the average cost of care compared to seniors who remain in traditional Medicare. That means taxpayers are paying more to private insurers than they would pay if the government directly paid for those seniors’ medical bills.

This situation persists despite MA insurers having come under withering criticism from the Medicare Payment Advisory Commission, advocacy groups and academic researchers for their systematically overcharging CMS. The industry bases its claims on the alleged risk of the patients under their care.

Industry launches campaign to roll back rate cut

Critics say MA plans accomplish this sleight of hand by upcoding — finding ailments in patient records that aren’t being treated. The Office of the Inspector General at HHS has consistently found that upcoding is widespread.

Numerous Medicare Advantage insurers are either in court or have paid hundreds of millions of dollars to reach settlements in lawsuits brought by whistleblowers and the U.S. Justice Department. Just last October, Cigna agreed to pay $172 million to settle claims it “submitted inaccurate and untruthful patient diagnosis data to CMS in order to inflate the payments it received from CMS.”

CMS proposed a rate cut next year because it is finally cracking down on upcoding. In a rule finalized last year, it eliminated some codes that were commonly abused by insurers seeking to inflate the medical risk of beneficiaries who join MA plans. They included codes like mild depression, diabetes-related co-morbidities, and peripheral artery disease, ailments often spotted on charts but left untreated. This new methodology was largely responsible for the slight cut in the proposed 2025 rates.

Despite the arcane nature of these regulatory changes and the lack of mainstream media attention to the proposed rule, the MA industry managed to gin up more than 13,000 comments from individuals across the country protesting the proposed rate cut. Most used exactly the same wording. “Medicare Advantage is a lifeline for seniors, and I am counting on you to ensure that 32 million beneficiaries have their Medicare Advantage coverage supported and protected from any proposed changes in the 2025 final Rate Announcement,” the final sentence of the five-sentence comment said.

I’ve written a lot about upcoding (see this post from last year’s rate debate or this editorial from Modern Healthcare, for instance). But now that over 50% of seniors have joined MA plans, the stakes have grown larger and more urgent.

Millions of relatively healthier seniors are joining MA plans because they are willing to accept the plans’ narrower networks, prior authorization and higher out-of-pocket costs. In exchange, most avoid the premiums they once paid for Medicare supplemental and drug plans. They also get a few extra benefits, although how many MA plan beneficiaries actually use those benefits is unknown. The lower upfront costs make MA a very attractive option for low-and-moderate-income seniors, who rarely think about their potentially higher out-of-pocket costs should they require care.

This ongoing shift of healthier beneficiaries toward MA — known as favorable selection in the insurance business — leaves traditional fee-for-service Medicare with a sicker and more costly clientele. This compounds the reward to private insurers selling MA plans since CMS’ risk adjustment payments are based on the actual costs of seniors who remain in the traditional program, not those in MA, whose precise medical expenses are poorly understood.

Favorable selection increased overpayment to plans by 14% on top of the upcoding grift, according to one recent study. These systematic overpayments resulted in Medicare paying MA plans by at least $88 billion, according to the 2024 MedPAC report.

Will CMS cave?

If CMS behaves like it has in previous years, it will adjust its proposed payment schedule to meet some of industry’s demands. Instead of a 0.2% decrease, the plans will probably get somewhere between a 2% and 3% increase.

That’s why I signed onto a comment letter to the proposed rule submitted by former officials at CMS and signed by more two dozen former agency officials, former MedPAC officials, business health insurance purchasing group leaders, patient advocates and academic researchers (and one semi-retired journalist, i.e., me). In addition to calling on CMS to hold fast to the proposed reduction, the letter asked CMS to:

Explore the creation of a new risk adjustment system that “is resistant to gaming,” such as using extended beneficiary surveys and basing reimbursement for any individual switching to MA on their risk-adjusted spending from the previous year.

Revise the benchmark average payment to MA plans to eliminate the program’s favorable selection bias; and

Work directly with Congress to create a level playing field for traditional Medicare.

This would require a Congress willing to update the overall benefit package to include items like vision and dental coverage, which are used by MA plans as an enticement for seniors to sign up for their plans. MA plans fund those extra benefits with the extra money they receive from CMS or with the 15% insurers take off the top for overhead and profits.

Absent such a Congress, traditional Medicare will continue to decline. MA plans will continue to grow. And the program’s fiscal solvency will increasingly be called into question by forces on Capitol Hill that would like to see Medicare entirely privatized.

Merrill,

I'm disappointed that your excellent analysis didn't draw more comments from your readers. Perhaps it's just fatigue - AHIP & PhRMA keep rolling out the same old tropes about impending disaster and the end of drug research. As an actively retired 85 year-old who first enrolled in Medicare 20 years ago, I've been enrolled in MA plans for the past ten years for two principle reasons:

1. the hospitals and physicians that my wife and I use virtually all were in-network; and

2. convenience; I no longer had to pay premiums to Medigap and a Part D drug plan as they all were rolled into the MA plan.

John