While Medicaid's enrollment purge plows on ...

Automatic enrollment across all plans would put an end to the constant churn in the ranks of the uninsured

Know someone who might enjoy reading my articles, please click on this button and:

A few weeks ago, I critiqued the inequities that would inevitably result from a bare-bones universal insurance plan offered by two economists, which I dubbed it “Medicare-for-all lite.” There was one part of their plan that merits serious consideration: Automatic enrollment for everyone in some form of health insurance.

The idea isn’t new. But it is particularly relevant now because state Medicaid agencies across the country are purging their rolls of people who no longer qualify, either because their incomes have risen or they failed to fill out the proper paperwork. Medicaid’s annual re-enrollment process, which must be initiated by beneficiaries, was put on hold during the pandemic.

Re-enrollment resumed with the end of the medical emergency earlier this year. At least four million of the 94 million people on Medicaid have already been dropped from the program. The number could grow to 17 million by the end of the year, according to the Kaiser Family Foundation. Most will lose coverage because of paperwork snafus, not because their households surpassed the income guidelines.

Many state governments failed to gear up for the task. The Associated Press reported this week that the federal government has issued warnings to a third of state agencies whose call centers have been overwhelmed by desperate beneficiaries trying to re-enroll. Many people hung up after waiting for 45 minutes or more. How many of the working poor who rely on Medicaid because their employers do not provide coverage have an extra hour during the work day to stay on hold?

Where it’s automatic and where it’s not

As things stand now, we have automatic enrollment in just one part of the nation’s fragmented insurance system. Everyone must sign up for Medicare when they turn 65. Once you’re on, you never get thrown off.

Private insurance, either through employer-sponsored or group plans or individual plans sold on the exchanges, is almost entirely voluntary. Fully one-third of people offered health insurance at their place of work refuse to sign up for plans, according to the Bureau of Labor Statistics.

The individual mandate in the Affordable Care Act was eliminated in the 2017 Trump/Republican tax bill. Only five states and the District of Columbia subsequently enacted their own individual insurance mandates.

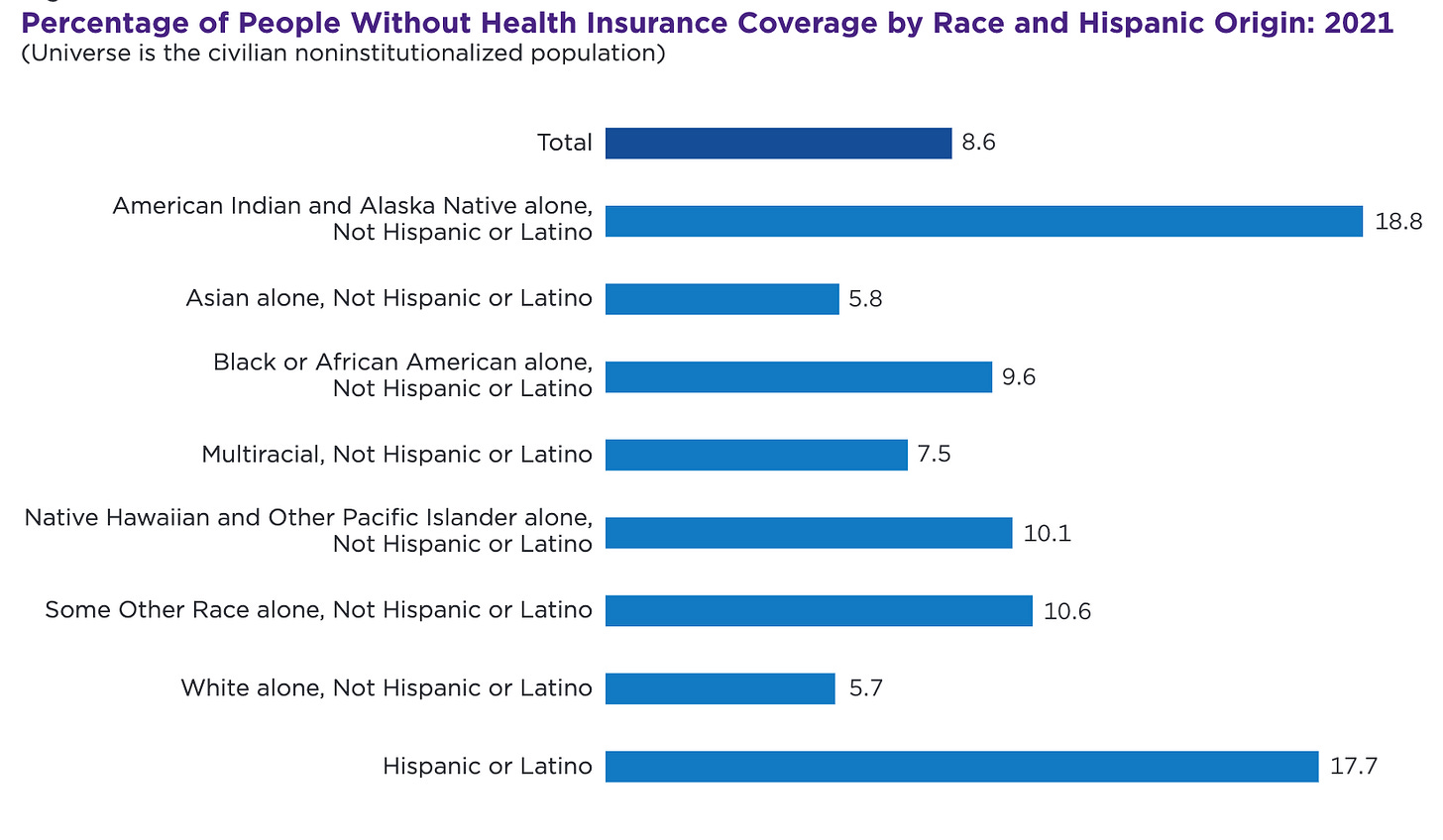

State-run Medicaid plans, which collectively are the nation’s largest insurer, are limited to the poor. Program beneficiaries must apply annually for coverage. Even before this year’s program purge, more than a quarter of the 28 million uninsured Americans who were eligible for Medicaid never applied. Another 37% of the uninsured were eligible for subsidies on the exchanges, but still decided not to buy insurance.

In other words, even under the U.S.’s existing fragmented system, near universal coverage could be achieved if everyone signed up for plans for which they are already eligible. Why haven’t people signed up? The uninsured cite cost as the number one reason for failing to enroll.

In 2020, 70% of the uninsured reported they could not afford a monthly premium above $75. The Biden new administration and Democrats in Congress tried to solve that problem with the 2021 American Rescue Plan, which expanded eligibility and raised premiums to the point where three-quarters of the uninsured could access a plan for less than $50 a month. Thanks to last year’s Inflation Reduction Act, those subsidies have now been extended through 2025. Enrollment surged, but nearly 30 million Americans still remain uninsured.

So once again we have to ask: Why don’t more people take advantage of those options. Why don’t they sign up for Medicaid when they’re eligible? Why don’t they immediately sign up for Obamacare plans when their household incomes rise to being merely poor from very poor?

Opt-out, not opt-in

One of the tried and true maxims of behavioral economics is that opt-out plans are far more efficient and effective at influencing behavior than opt-in plans. Saving for retirement at work becomes near universal when people are automatically enrolled, for instance.

Every health insurance option should adopt Medicare’s formula: People are automatically in unless they opt out. No more mandates. Let’s learn from recent history. Don’t give Republicans another opportunity to claim Democrats are “trampling on the freedoms of Americans.”

It would have to work differently for each type of plan. Employers and insurers offering group plans would have to provide full disclosure of out-of-pocket premiums and other costs for every type of plan they offer, and an easy method for employees to opt out. The carrot would be the end of the employer mandate since people working at firms that don’t provide coverage would be automatically enrolled in individual plans sold on the exchanges.

The opt-out strategy for Medicaid and the individual market would be a bit trickier since both have income limits for participation (in the case of Medicaid) and subsidies (on the exchanges). The state agencies that manage Medicaid and the exchanges that offer individual insurance plans depend on income disclosures made annually to the Internal Revenue Service.

Given today’s computer capabilities, it should be relatively easy to have individuals check a box on their income tax forms that indicates whether they have health insurance, just as they did when the individual mandate and its penalties were enforced. The IRS in turn could provide information about those who don’t have coverage to the states and exchanges, which could then automatically enroll those without coverage in the lowest cost option available. At the same time, the exchanges could give them the option of opting out or switching to a plan that better suits their needs.

Should Democrats regain control of Congress and retain the White House after the 2024 election, the timing may be right for finally achieving near-universal coverage through automatic enrollment and an opt-out option — without resorting to mandates or trampling on individual freedom.

Nice piece but one caveat-- Medicare enrollment is not as simple or automatic as you say here. It is automatic once you're receiving Social Security (either at 65 or after 24 months on SSD) but many people delay Social Security and have health insurance from work. The rules around enrolling after 65 are very complicated and despite recent efforts to simplify legislatively still snare quite a lot of people. One difference is that people over 65 or disabled almost always want to be insured so they generally make the effort. But it's far from the automatic enrollment we should have. Even free Part A isn't truly automatic.

Merrill:

I believe most of the people who were on Medicaid were automatically enrolled. Most of the ones who will be dropped from Medicaid did not know they had to re-enroll yearly. Either they moved, just plain did not know, understand the process, etc. The states were more than happy to drop them even though much o the cost was paid for by the Feds. The meanness of the Wisconsin government gives even more reason for these people to be automatically enrolled again. The cost of treatment is far less than commercial insurance which something in the realm of 200% of Medicare.

Yes, it is probably the best a state can do which is why the Feds can do better and Single Payor as Kip Sullivan's writes should be the goal. Much of the clerical function and the differences would disappear..

Bill @ Angry Bear